Review: The Triumph of Injustice

Or, the coming debate on moral incidence of taxes

You're going to hear a lot about the triumph of injustice in the next 6-12 months. Or rather, you're going to hear a lot about The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay, by Emmanuel Saez and Gabriel Zucman (2019).

For one thing, the two economists have signed on as economic advisors to 2020 presidential candidate Elizabeth Warren, who has for years been putting questions of economics and notions of justice front-and-center. But more generally, economic justice is having a moment, and I prophesy that you'll hear more about it before you hear less.

So this is my first real attempt to understand exactly what kind of moment it is, in the best way I know how -- by writing. Specifically, by writing a review that unpacks TToI for non-economists. (I am an economist, but not the kind that helps p— I mean, not a macroeconomist. I have macroeconomists in my blogroll; that's my primary qualification here.)

One note before we begin: I really don't want to wade into the Economics-Twitter debate about academic standards and practices that arose around the publication of TToI, when review copies were circulated to journalists before economists, and the data tables were delayed from the book release by a few weeks. I think that that discussion of Saez and Zucman's work is framed to produce heat rather than light, and I'm not particularly interested.

So we start the discussion with what we know now, setting aside the question of how we got here. Go somewhere else if you want uncharitable takes on tax imputation methodologies.

(1a)

TToI combines data from Piketty, Saez, and Zucman 2018 ("Distributional National Accounts: Methods and Estimates for the United States", QJE 133(2)), some additional data and estimates, and new analytic tooling to answer different questions. (Some readers will recognize Piketty from Capital in the Twenty-First Century, as reviewed by SSC.)

Whereas PSZ2018 investigated (1) the realized distribution of incomes in the US and (2) how tax and redistribution policy made things easier and harder for Americans of varying incomes, TToI asks more direct (and one might say more practical) questions. To wit:

- "Who pays taxes in 2018 America?", and

- "Is that fair?"

These are different questions than the ones that PSZ2018 (and most everyone doing conventional economics) asks, and the difference has confused a lot of the discourse around this book, so I want to unpack them a bit.

(1b)

The first question is "Who (morally speaking) pays taxes?" Notably, this question is not the same as "Who is made better/worse off by taxes?" This choice of focus departs from the standard economic analysis (including PSZ2018), which is primarily concerned with economic outcomes and chains of cause/effect.

As one example of the difference, if the government raises taxes on corporations and thus some companies go out of business and others raise prices on consumers, the incidence of the tax is borne partly by corporation owners (in lower profits) and partly by consumers (in higher prices). This is a descriptive fact about predictable economic outcomes, even if the tax payments themselves come from corporate treasuries.

But TToI is primarily a normative discussion of moral economic justice, and from a (commonsense-)moral perspective, the distal effect of corporations' responses matter less than the direct action of the tax itself. (This is a non-consequentialist moral position, of course; what else did you expect from a book that puts "injustice" front-and-center?) Lest you think I'm misrepresenting the authors here, here it is in their own words:

The question of who pays the taxes collected by governments today is different from the question of how the economy would look if specific taxes were lower or higher tomorrow -- what economists call, quite confusingly, "tax incidence." For example, what would happen if the corporate tax rate were cut? In principle, many things could change: firms could boost shareholder income with higher dividend payments or share buybacks; they could increase the wages of their employees; they could slash the price of the products they sell; they could expand investment in factories or in research and development.

We will discuss questions of tax incidence later in the book, in the context of potential reforms. In the meantime, the critical thing to understand is that determining who pays existing taxes is a different project from imagining how the world would look if those taxes were changed. Regardless of what firms might do if the corporate tax rate were cut tomorrow, today’s corporate taxes are paid by shareholders and nobody else. (p. 13; emphasis mine)

If you try to read this book as the authors asking about the consequences of taxes, you'll be confused, because their analysis is more directly about "Who pays?" in a moral sense.

(1c)

Now, "Who pays?" is not quite as simple as "Who writes a check to the IRS?" in the moral calculus the book proposes:

The main hurdle to figuring out who pays what is that although in the end only people pay taxes, the entity that legally remits the check to the IRS is not necessarily the person who pays the tax. For instance, employers remit half of federal payroll taxes and employees pay the other half. But the distinction is meaningless: in the end, all payroll taxes are based on the labor income of workers. That these taxes are administratively split into two parts -- one remitted by employers, the other by employees -- is a legal fiction that has no economic implications. (p. 12; emphasis mine)

This does seem like the only reasonable way to make sense of payroll taxes; a world where every worker were paid 6.2% more in nominal wages but needed to pay precisely that much more to the government seems precisely no more or less just than this one. Because these employer-paid taxes are based so mechanically on the nominal wages employers pay workers, the authors consider them morally 'paid' by those workers. (Similarly, sales taxes are remitted by goods sellers, but the authors' framework assumes that they are morally 'paid' by buyers in higher net prices.)

aside: I'm honestly not sure whether the authors adjust taxpayers' nominal incomes for the taxes paid on their behalf by employers. If not, then that would imply that pre-tax incomes are understated by at least 6.2% for the bottom 90%tile of incomes, and lower-90%tile tax rates are overstated by 1.5 percentage points (5.8% of total tax rate).

Are pre-tax capital incomes overstated and tax rates on capital also overstated by similar effects? Also not sure.

(1d)

Another consequence of the authors' focus on proximal justice -- rather than ultimate outcomes -- also appears in their handling of payroll taxes. FICA payroll taxes (a 15.3 percentage-point share of taxes on the lowest 9 deciles of incomes) fund social benefits like Social Security and Medicare.

aside: Roughly speaking, the way Social Security works is you pay into your account for 10-35 years, and later get paid (each year) 3% of your account total over $290k, 7% of your account total between $48k and $290k, and 21% of your account total under $48k.

There aren't actually segregated accounts -- incoming money pays outgoing obligations, Ponzi-like -- but the formula credits individuals for their contributions (albeit with large accounts subsidizing smaller accounts a bit).

Saez and Zucman, in separating moral questions of proximal taxes from questions of benefits, treat these payroll taxes as a massive flat/regressive tax on labor income:

The second largest source of tax revenue is Social Security payroll taxes (8% of national income). These taxes are levied on labor earnings and come out of wage earners' paychecks -- from the very first dollar earned—at a rate of 12.4%. They are capped at $132,900 a year in 2019, a figure that roughly corresponds to the threshold for being among the top 5% highest wage earners. Any earnings above that cap are exempt from taxation, making Social Security taxes deeply regressive. A separate tax is collected to fund Medicare -- the government health insurance program for the elderly -- at a rate of 2.9% on all earnings. Altogether these payroll taxes, which were small fifty years ago, have grown to become almost as large as the federal income tax itself. As we will see, this development has significantly contributed to eroding the progressivity of the American tax system. (p. 10; emphasis mine)

Again, you'll confuse yourself if you think the authors mean this as a statement about economic outcomes, because it's a statement about commonsense-moral justice. People really do think of FICA taxes as costs (not as an investment program), so it's a tax in the moral calculus of tax justice, as felt by the taxpayers we have. This is important; in fact, it's all of what the book is about.

(1e)

Why do the authors focus on moral-normative justice instead of economic outcomes? Because their interest in justice is, by their own account, grounded in defending liberal globalization from populist uprising:

Development is not primarily a matter of mechanically collecting taxes to fund spending, no matter how useful this spending may be. Development is about building trust in institutions, including, most importantly, governments. When governments take more from the poor than from the wealthy, sustained trust becomes impossible. (p. 177; emphasis mine)

and:

Beyond America, our story is more fundamentally about the future of globalization and the future of democracy. For although the changes in taxation have been extreme on this side of the Atlantic, the triumph of tax injustice is not specific to the United States. Most countries have, to a varying extent, seen inequality rise and tax progressivity fall in a context of rising tax avoidance and unfettered tax competition. The same questions bubble up throughout the world, with the same urgency: If the taxes enacted by our elected officials keep boosting the income of a privileged minority, who will keep faith in democratic institutions? If globalization means ever-lower taxes for its main winners and ever-higher taxes for those it leaves out, who will keep faith in globalization? There is no time to lose: We must invent the new fiscal institutions and the new forms of cooperation that will help democracy and international openness flourish into the twenty-first century. (p. xi; emphasis mine)

It is for this reason that a Pigouvian tax on the negative externalities of carbon is morally fraught, since the rich produce less carbon per dollar of income than the working and middle classes:

Take environmental taxes. Putting a price on carbon is critical to combat climate change, but since spending on fuel and other carbon-intensive goods absorbs a greater share of income for the poor than for the rich, carbon taxes are typically regressive. To offset this pain, fighting climate change will require additional progressive taxes. Governments that forget this basic truth will learn it the hard way. (p. 178)

and it is for this reason that it's especially urgent to tax appreciated wealth now, instead of using capital-gains and dividend taxes when when capital wealth is later realized:

At some point even the rich consume their savings, but that can be decades after income has been earned (if savings are used to fund retirement) or centuries after (if savings are passed to successive generations of heirs). The fundamental injustice of consumption taxes, relative to income taxes, is that the well-off can postpone them by saving, while the poor pay cash on the nail. "Justice too long delayed is justice denied": this is true also when it comes to taxation. (p. 185)

The focus on emotionally-salient justice also further explains why the authors choose a treatment of transfer income and taxes that implies degenerately high tax rates at the very bottom of the scale:

At the very bottom of the distribution, people do not earn labor, capital, or pension income but only transfer income; they pay consumption taxes out of this transfer income, which leads to high tax rates when expressed as a fraction of pre-tax income [which excludes transfers]. We avoid this problem by restricting our population to adults with pre-tax income more than half the annual federal minimum wage ($7,250 per year). The average tax rate in that population is almost identical to the macroeconomic rate of taxation. (p. 202)

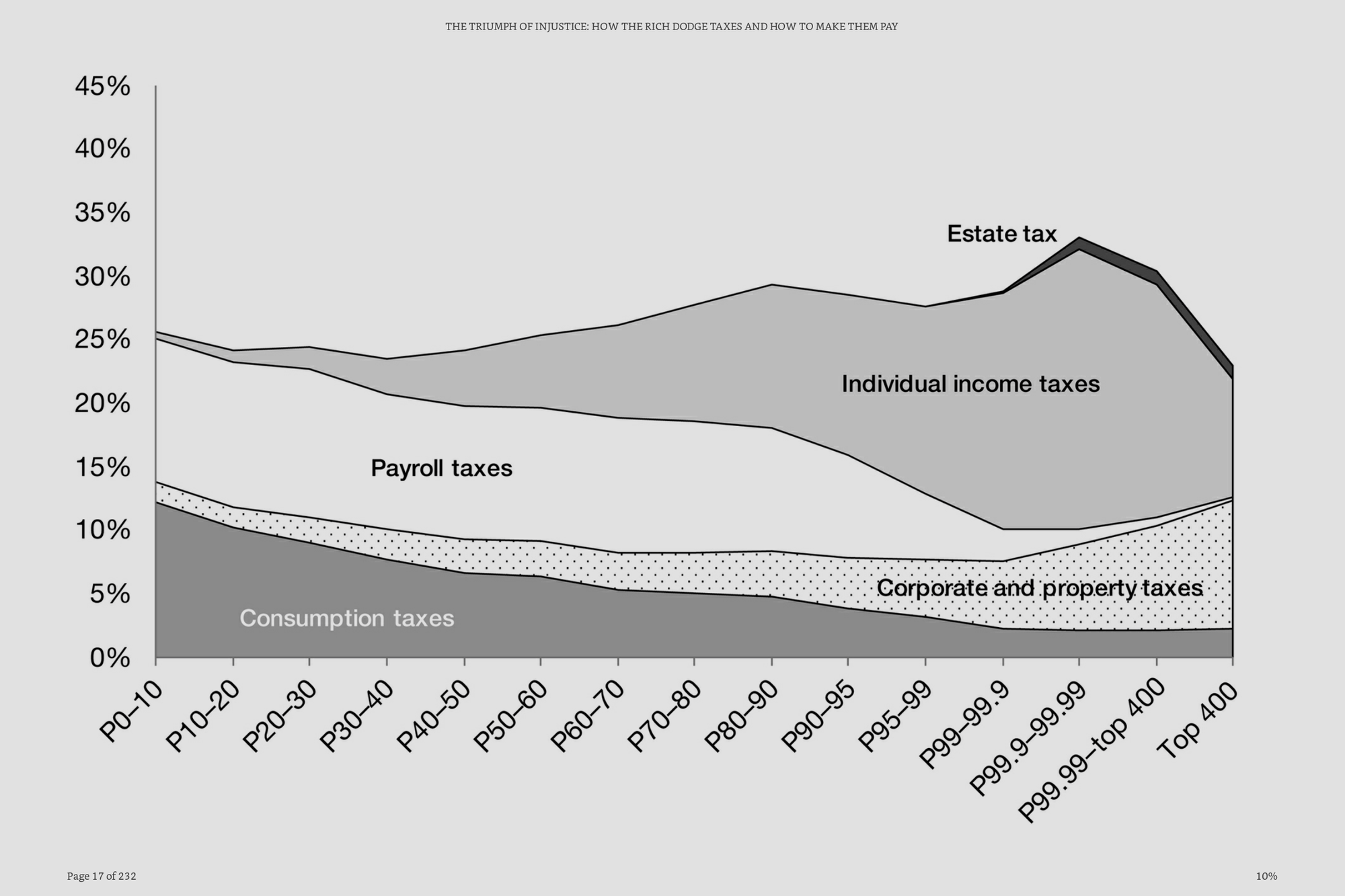

which explains the intended point of the left-hand side of this graph:

where the lowest decile appears to pay as much as 12% in consumption taxes, despite no US state having sales tax above 10%. (Additionally, groceries -- as much as 15% of consumption -- are discounted or exempted in many localities, implying non-grocery consumption tax rates in the high teens of percents.)

To drive this point home one last time: This would be a grossly misleading presentation of the data if the authors were attempting to explain how taxation affected the economic outcomes of the working class, who are precisely no worse off if the government pays another 10% in benefits but then demands it back in sales taxes. But that's not the central question of the book. From an emotional, moral, and political perspective, giving people more money and taking it back in extra taxes would (and in fact does) significantly increase political ill will against the establishment.

If the mission is to defend public trust in the government, then it's emotional facts -- not economic facts -- that matter. And it matters what the rich appear to pay (in the common sense of 'pay') today, not what they'll actually pay tomorrow. If that's not high enough, well, bad news for globalization and our democratic institutions -- regardless of what simple economics can tell us about tax incidence.

(2)

Between tracts of moral commentary and political prophecy, TToI casually drops completely wild facts about tax policy through the ages. What shocked me most was that some cases it moved breathtakingly fast.

To pull just a few:

- 1990s France levied 50% payroll taxes on minimum-wage workers. (p. 16)

- In 2018, US corporate tax was cut from 35% to 21% by executive fiat -- and in the same year 17% of corporate profits fled overseas (or to other tax-free dodges). (p. 19)

- From 1913 to 1917, the US income tax rose from 7% to 67%. (p. 33)

- From 1931 to 1936, estate tax rose from 20% to 70%. (p. 34) This, with the previous, implies a total statutory confiscation of 95% of inherited capital wealth in the upper class in less than a generation. 95%!

- During the Civil War, "the debate about how to tax the wealthy had involved rates between 0% and 10%. [Seventy years later, in the context of WWII,] the question was whether 90% or 100% was more appropriate." (p. 36)

- From 1975 to 2018, the fraction of US estate tax returns audited by the IRS fell from 65% to 8.6%. (p. 58)

- In 2010, with FATCA, the US unilaterally demanded that foreign banks -- even those subject to foreign privacy laws -- turn over holdings and income information on American citizens, on threat of a 30% penalty tax on the bank's US capital income. Every global bank lobbied overseas governments until bank privacy laws were rolled back across the globe. (p. 65)

I had kind of assumed that tax policy was just too boring to move faster than an unmotivated tortoise, but these stories make the case that I'm wrong. Insofar as Saez and Zucman set out to convince readers -- by a multitude of astounding anecdotes -- that the formerly unthinkable can be simply enacted by legislative fiat when its political moment is ripe, the book is a massively compelling.

They themselves phrase this historical perspective as "What's been accepted yesterday can tomorrow be outlawed." (p. 66), and while I had a keen appreciation for the corresponding phenomenon in financial regulation, I didn't appreciate how true it was in tax policy as well. Maybe this is just how all of government secretly works, if you're paying attention? (cf. Gell-Mann amnesia effect) Tyler Cowen phrases the corresponding effect for monetary institutions as "every era's institutions are unimaginable until they're real", which seems about right.

The political message that accompanies this reading of history is clear: Neither national sovereignty nor freedom of contract nor quantitative precedent binds US (tax) policy in the modern era. I'm certain that this overstates the actual case somewhat, but I'm also near certain that we'll start to hear more and more radical proposals -- based loosely on twentieth-century precedent but upgraded with twenty-first-century American omnipotence -- that repeat seeming impossible plans until social consensus forgets how impossible they once seemed, and then they happen.

(3a)

note: I've partially retracted the argument of this section, as per this later post, without edits to the original here. Later sections of this post basically stand independently.

Elsewhere, regarding the supply-side effects of tax policies, I'm reminded of what's good about economics, as per John Cochrane. (I'm hoping that if I've kept you here this far, you'll bear with me for a discussion of elasticities and supply curves.) That is:

Economic theory also forces logical consistency that would not otherwise be obvious. You can't argue that the labor demand curve is vertical today, for the minimum wage, and horizontal tomorrow, for immigrants. There is one labor demand curve, and it is what it is. Economics lets one experience illuminate the other, and done right forces politically uncomfortable consistency on those views. (...)

What happens when we apply this insight to the wealth supply curve, instead of the labor demand curve? The economic argument proceeds similarly:

- If marginal wealth is taxed an additional 0.5%/yr at the high end, then fewer people will amass and invest that much wealth -- some will instead disperse it among a wider number of family members, donate it to charitable or political causes, or spend it on expensive consumption. (Saez and Zucman, in their potential-revenue analyses, assume that this effect is quite small, and that the wealthy will mostly accept lower returns on wealth.)

- Similarly, if the marginal opportunities to invest became worse by 0.5%/yr, fewer people would chose to invest, by the same token. Additionally, the effects should be the same size, as it's the same decision-makers facing the same incentives!

- But if pushing on the price (read: rate of return) has little effect on the quantity of investment, then pushing on the quantity of investment should have a large effect on the price! (Unless we're at some magic kink in the supply curve for unspecified reasons...)

- So a small amount of additional capital competing for investment opportunities should quickly reduce the competitive rate of return.

What's the practical upshot? Well, if the authors' assumptions about revenues are right, then Piketty's \(r>g\) "wealth spiral" can't proceed unchecked, since capital simply can't accumulate without competition quickly reducing the average rate of return back below \(g\).

aside: \(r>g\) (read: "the rate of return on capital exceeds the growth of wages") is Piketty's explanation for the runaway accumulation of capital faster than wages. His Capital in the Twenty-First Century argues that extended peacetime rates of \(r>g\) is the primary cause of the rising capital share of income.

More generally, if the supply of investable capital is inelastic with respect to the prevailing rate of return, accumulation of wealth should be self-governing. Now, TToI also blames creeping (and not-so-creeping) tax cuts for the rise of capital income share, but even so, a supply curve is a supply curve -- capital should quickly crowd out its own accumulation if supply is in fact inelastic.

(3b)

I think that the cleanest resolution to this dilemma (for our authors) is to accept that supply of capital is elastic, and that the wealth-tax revenue estimates are wildly overstated. After all, surprisingly little of the book's primary thesis actually depends on raising money from taxes; convincing the rich to simply earn less is just as good at making them have less, and one gets the sense from TToI that if Saez and Zucman spent six days collecting taxes from the richest 0.1%, they would rest on the seventh day.

They cite approvingly the Roosevelt-era tax policy, which had an explicitly confiscatory mandate:

From the presidency of Franklin Roosevelt to that of Dwight Eisenhower, it was clear that the top marginal income tax rates did not add revenue. They were of the "wrong" side on the Laffer curve. They destroyed income.

This was not a bug: it was the goal of the policy. The quasi-confiscatory top rates championed by Roosevelt and his successors in office were meant to reduce the income of the super-rich and thereby compress the income distribution. (p. 155; emphasis mine)

and later they come right out and say that we should be doing it today, too:

This is the theoretical case for going beyond Laffer. Extreme wealth, like carbon emissions, imposes a negative externality on the rest of us. The point of taxing carbon is not to raise revenue but to reduce carbon emissions. The same goes for high tax rates on the very highest incomes: They are not aimed at funding government programs in the long run. They are aimed at reducing the income of the ultra-wealthy. They prevent or impede the various forms of rent extraction associated with extreme and entrenched wealth and with the reality of the market economy in unequal societies. What's the point of negotiating a $20-million salary, of earning millions by creating zero-sum financial products, of spiking the price of patented drugs, when out of any extra dollar earned, 90 cents will go the IRS? When in place, quasi-confiscatory tax rates redistribute economic power, equalize the distribution of pre-tax income, and make the marketplace more competitive. (p. 159; emphasis mine)

That's from the chapter titled "Beyond Laffer" -- where 'beyond' doesn't mean 'transcending the model of', but plainly 'setting tax rates above revenue-maximizing levels'.

(4)

Stepping back out of the technical weeds, I stand by my original claim: In spite of (or perhaps because of) its unconventional normative approach, The Triumph of Injustice is one of the most comprehensive explanations of (one side of) tomorrow's tax policy debates that you can read today. It's also written for a popular audience and generally light reading, so you don't really have an excuse for not reading it before wading into the comment wars.

If I'm right, though, then those debates will be absolutely infuriating as participants repeatedly misunderstand each other, the one side arguing from consequences and the other from moral norms. The early volleys on Economics Twitter about Saez and Zucman's economic methods were full of this, and if you thought that that was bad, just wait until tax justice makes it to primetime presidential debates.

Oh, it has? The Democratic primary debates have started already? Well, I've been rather enjoying my expatriate filter bubble, so I think I'll go back to ignoring them until, I dunno, two months before my primary election? Wake me up in February, please.

There's plenty more ink to be spilled on the topic of tax justice (to say nothing of the entire other half of the redistribution story), but this review has gone on for long enough, and I'd like to stop on this side of four thousand words. Book is worth reading, if only so you have better context for the national debate that's coming next. Or so I'd guess.