PredictIt Arbitrage

note: Long after I posted this, PredictIt changed their policies on margin requirements in "linked markets", a small step towards market efficiency. Nevertheless, they left in place their 5% tax on withdrawals and 10% tax on gross profits, so the central argument that inefficiencies can stop even the most commonsense arbitrages from correcting out-of-line markets, remains largely true.

(1)

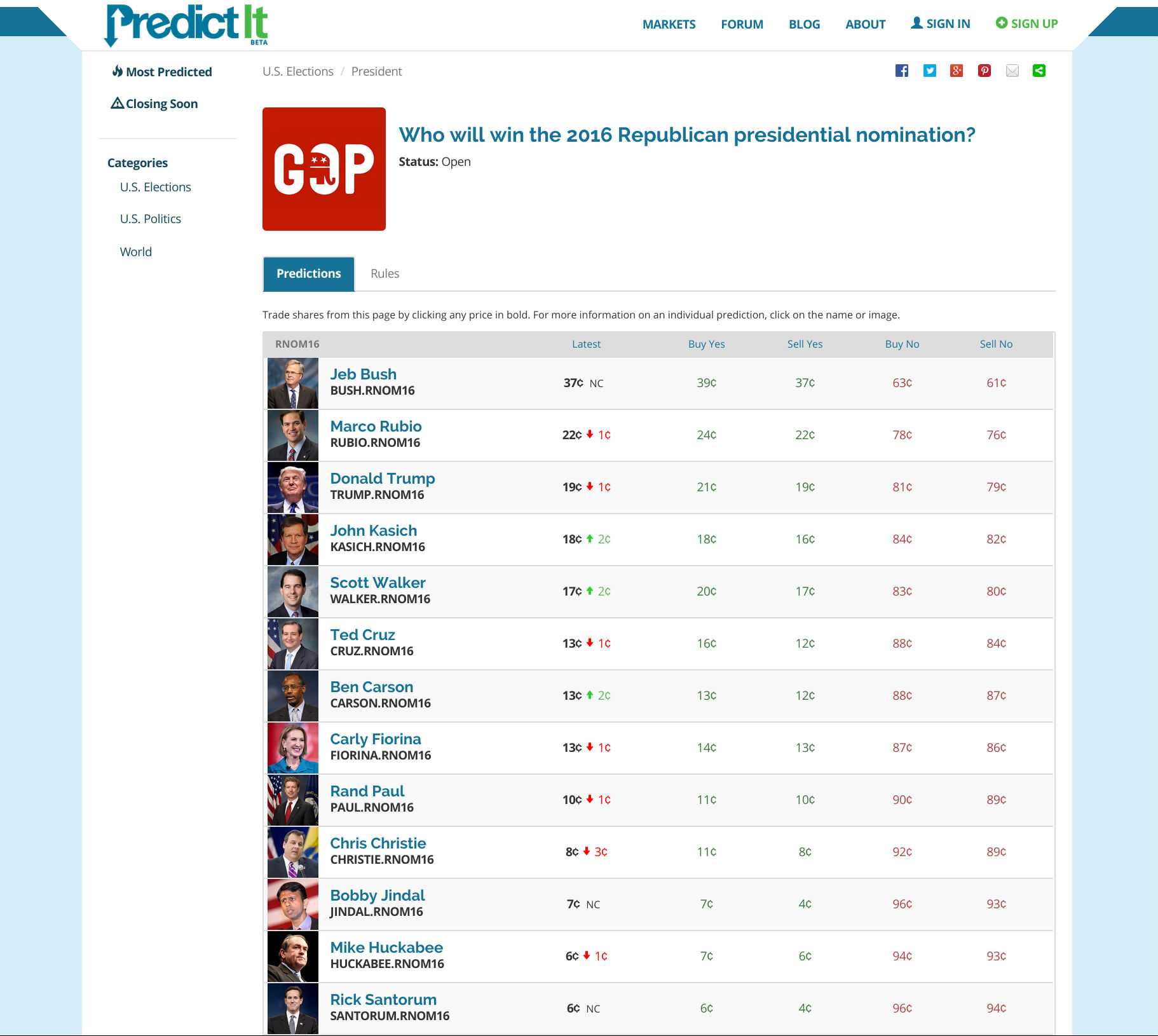

Political betting site PredictIt offers everyone the ability to (legally) bet (real money) on the outcome of political events. For example:

You can pay 39¢ for a Yes share in BUSH.RNOM16, which will be worth $1 if Jeb Bush wins the Republican nomination, and $0 if he does not. Similarly, you can pay 63¢ for a No share in BUSH.RNOM16, which will be worth $0 if he wins and $1 otherwise. (Another way to think about this is that you can sell a Yes share for 37¢ or buy one for 39¢. These numbers are different for pretty much the same reason that you can't sell your used textbooks back to Amazon for the full price you paid.)

If you have a strong information that Bush is, say, 50% likely to win, then you might buy a lot of Yes shares, and therefore drive the price up. In this way, the market records a sort of weighted-vote among the people willing to bet on the site -- the fact that it's stabilized at 37¢–39¢ should mean, in an efficient market, that all participants agree that the probability that he wins is above 37% and below 39%. If they disagreed, they could make money in expectation by betting their beliefs, which would move (or at least widen) the market.

Correspondingly, if you believed that 37% was too high, then you could buy some No shares for 63¢ each, and thereby make money in expectation. (You could also think about this as short-selling Yes shares for 37¢ each, but the Yes/No share model is the one that PredictIt uses, and besides, I hope it'll be less confusing to readers not used to thinking about trading in two-sided markets. In any case, selling Yes and buying No are equivalent as far as PredictIt's markets work.)

I say "in an efficient market" because, well, this one is not. If you look at the last-traded prices for candidates, you get implied probabilities of

- Bush 37%

- Rubio 22%

- Trump 19%

- Kasich 18%

- Walker 17%

- Cruz 13%

- Carson 13%

- Fiorina 13%

- Paul 10%

- Christie 8%

- Jindal 7%

- Huckabee 6%

- and Santorum 6%.

If you do the math, these numbers add up to 189%. The next page of candidates (oh yes, there are more...) reads:

- Graham 5%

- Perry 5%

- Ryan 5%

- Palin 4%

- Romney 4%

- Martinez 4%

- Pence 3%

- Pataki 3%

...for a total of 222%. Now, if you're objecting "That can't be right; these probabilities should add up to 100%!", then you'd be absolutely correct. It is a mathematical fact that at least six of those numbers are too high.

Wait, if we know that, shouldn't we be able to bet against the market, and make money by doing so?

In theory, yes. Consider a simplified example, where there are three candidates, named Red, Blue, and Green. If the markets are trading at

- Red 50%

- Blue 40%

- Green 30%

in the Yes shares, so that the market-implied \[P(\text{Red})+P(\text{Blue})+P(\text{Green})=120%,\] then that means that the No shares are trading for

- No Red 50%

- No Blue 60%

- No Green 70%

and if you bought one of each, you'd end up paying \(50¢+60¢+70¢=$1.80\). But you'd be guaranteed to be right in two of them (since only one candidate can win), so you'd get paid out $2 at the end, for a profit of 20¢ -- or 11% of what you put in. If you put in $900, you should be able to walk away with a guaranteed $1,000 come July, for a profit of $100. In the business, this is known as arbitrage, a synonym for "no-risk, positive-return trading".

So why isn't this happening?

Well, let's dig into the math.

(2)

edit: PredictIt has since revised their policies to require only enough margin to cover the worst-case scenario of a linked-events market, rather than the full downside of each leg. I assume the markets have moved accordingly, though I'm not going to re-run the numbers.

First, recall that, even though, say, the No share in KASICH.RNOM16 last traded for 82¢, you can't actually buy it for that price right now, since the market is 82¢–84¢ -- you can buy for 84¢ or sell it for 82¢. (Or, if you liked, you could join the line of people trying to buy for 82¢. Or you could jump in front of all of them by offering to buy for 83¢. In both cases, you'd be waiting for some other person to come along and sell you the No share at that price. Since we're more interested in trading immediately, I'm only going to discuss trades against the already-quoted markets.)

So, if we're looking at the strategy of buying up a bunch of No shares, we should look at the prices we can actually buy those shares for. In some cases, this will be the same as the last-traded price -- because, say, the last trade was someone buying No and the market hasn't moved since -- but in others, such as Kasich's case, it won't be.

Anyway, we can add up the price of buying a No share in each candidate, to get \[63¢+76¢+80¢+83¢+84¢+87¢+89¢\\+87¢+92¢+89¢+94¢+95¢+96¢+97¢\\+96¢+98¢+99¢+96¢+98¢+98¢+97¢=$18.94\] for a total of 21 shares. Since at least 20 of them will pay out -- for a total of $20 -- you'll be $1.06 richer, a 5.6% return on your investment. Pretty nice.

...assuming, of course, that you didn't read the fine-print fee structure: (at the bottom of this page)

Money Management and Identity Verification

...

You can also withdraw funds from your account on the Funds page. Withdrawals are subject to a 30-day holding period after your initial deposit and a 5% processing fee...

Your profit and our fee

Whenever you sell a share for a higher price than you paid, we charge a 10% fee on your profit... The same fee structure applies if you hold onto your shares until the closing date and they are redeemed for $1... We never charge a fee if you break even or sell shares at a loss. (...)

So, even if you had $20 in your account, you'd only get $19 when you went to take it out. Worse, you wouldn't actually see $20, because instead of getting paid $1 per contract, you'd net $1 less 10% of the profit you made. This is even worse (for you) than simply applying a 10% tax on net profits, since it's calculated on gross profits, not net profits. (So if you win $1 on one bet and lose $1 on another bet simultaneously, you'll be 10¢ poorer.) All told, it means that (in the best case, where Bush wins) you'll make an after-fees net profit of 89¢, and see $19.83 in your account. You'll be able to withdraw it as $18.84 in real cash, for an -- oops! -- total loss of 10¢.

At this point, you may be noticing a slight inefficiency in our strategy here -- since we're only making a 1% return (well, 0.9% after fees) on our Sarah Palin bet and paying an almost 5¢ fee to take our 99.9¢ out, we're just losing 4¢ on the trade. So let's forget about any candidate where buying No costs 95¢ or more: Jindal, Santorum, Graham, Perry, Ryan, Palin, Romney, Martinez, Pence, and Pataki. Then we end up paying $9.24 for a bet that pays $10 before winner's fees -- $9.86 after -- and $9.37 after withdrawal fee. That's 13¢ on a $9.24 investment...a 1.38% return!

If we're even more clever, we can cut the most-expensive bets to improve our percentage return -- cutting Huckabee raises us to 12¢ profit on an $8.30 investment, a 1.49% return. Since our money is going to be locked up until July, we can compute the annualized return, which is in the ballpark of 1.61%. (If you're curious, a similar trade in the general-election race will give a 1.83% return, but only 1.5% annualized, since you may have to wait until November to get your money back.)

Wait, so can you make 1.49% return on your money with this one weird trick? Isn't there some scam?

It doesn't look like there's much of a scam here, except...1.49% is pretty bad. Harvard's endowment made 15.4% last year, and the S&P500 index turned some 13.5%. We've been having a slow year for the stock market by all indications, and the S&P has already seen a 3.3%-ish return. 1.5% is pretty bad, as far as these things go.

And that's before you account for the probability that PredictIt disappears at some point in the next year and you never get your money back, which has a probability of...what...probably more than 1.5%? I mean, they've got a letter from the CFTC that says that their business is okay, but still...

Were it not clear, I've determined that I do not want to make this trade. (What, you thought that I was going to explain it to you while it was still good?) If you do, please do not do so under the apprehension that any of the foregoing was responsible investment advice. And definitely don't come to me when PredictIt raises its rates and you lose your money.

(3)

Long story short, the candidates' collective odds of winning the nomination sum to 189%, but because of PredictIt's relatively hard-to-trade fee structure, there isn't enough of an incentive for people to enter the market and actually fix it. For that matter, unless you're expecting to keep your money in for more than this election cycle, why bother ever selling a <5% candidate? (...and so why should we expect the markets to accurately reflect the odds of candidates who are <5%?)

But the first five candidates still add up to 113%, so we know that at least one -- and probably all -- of them are too high. Maybe keep that in mind the next time that a news site claims that markets are predicting that Donald Trump has a 19% chance to win the nomination or whatever. Prediction markets can be useful tools in political forecasting -- and they will probably keep showing up in New York Times headlines -- but if they're not easy to trade in, they're going to be a bit...off...a lot.

This is, as I see it, not a argument for less political betting, but more, in better markets. If there were more (legal!) betting in the US, we wouldn't have to rely on shoddy companies with restrictively high fees, since competition would drive prices down, and in any case, increased volume would allow companies to survive on lower fees. (The possibility of markets allowing margin betting I'll defer -- indefinitely -- to another post.)

After all, the whole world benefits by having a clearer picture of how the future will shape up -- businesses can make better plans, hopeless candidates will be quicker to realize that they're dead (and not waste so much money), and the rest of us will (in any sane world) have to endure marginally less unsubstantiated blathering by TV pundits. Jeff Kaufman agrees, and he's a freaking Quaker.

In conclusion: