Metaculus and medians

or, Scope-sensitive snafus in summing speculations

previously: Metaculus has some issues

(1)

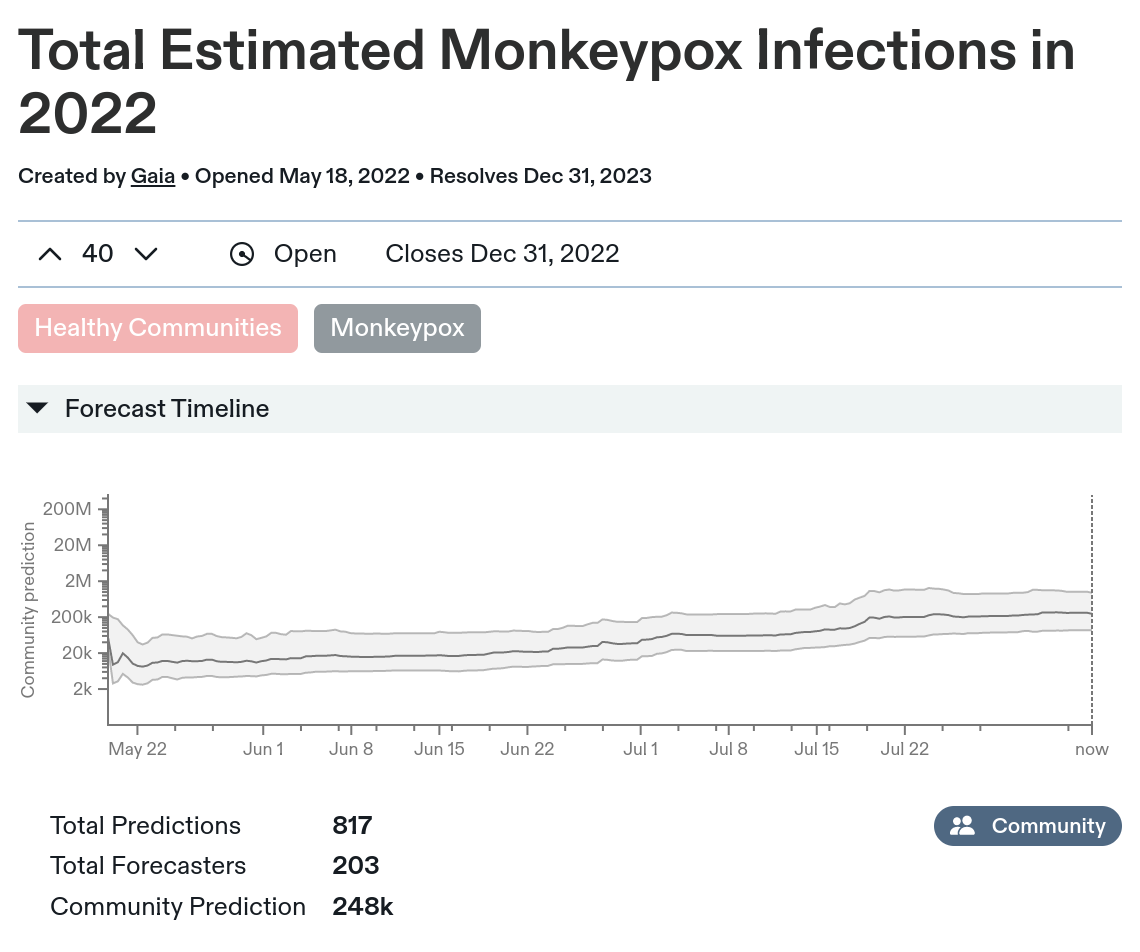

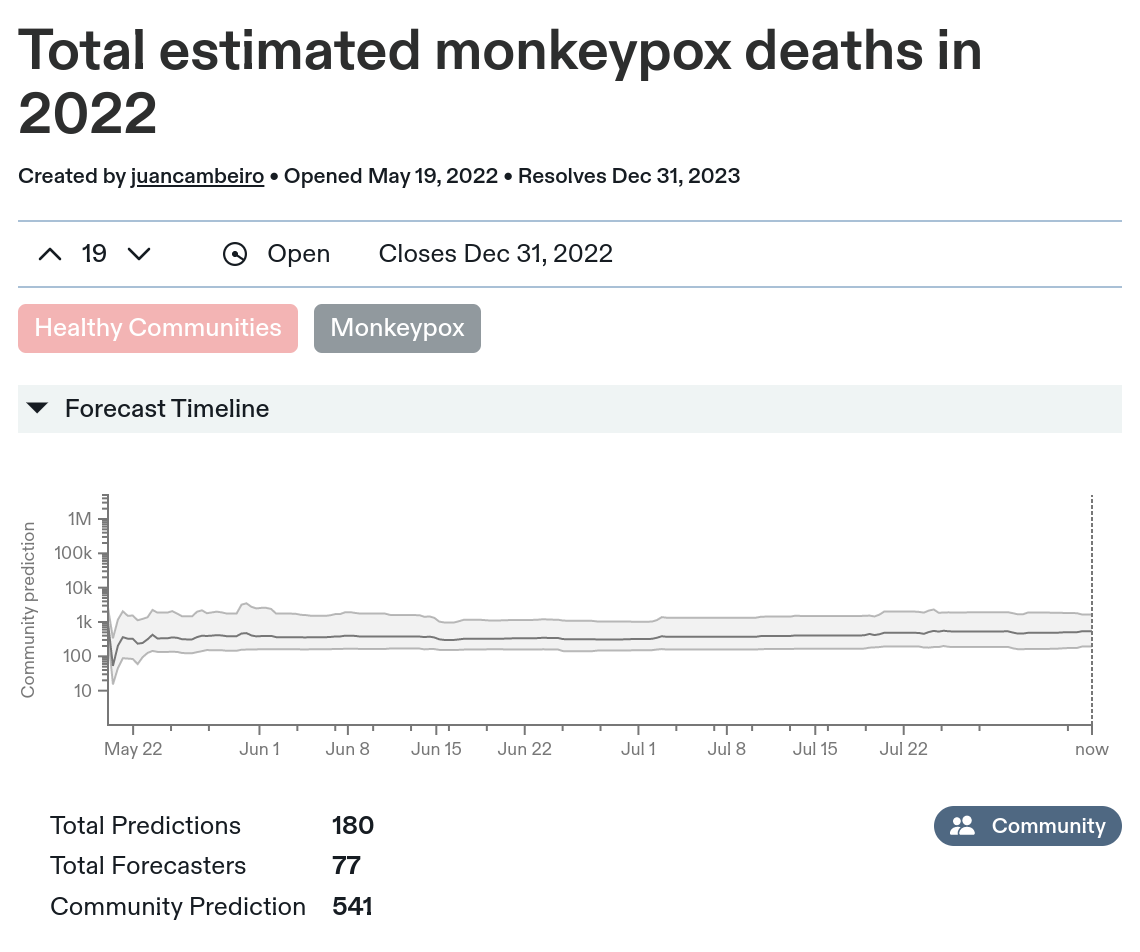

Should I expect monkeypox to be a big deal for the world? Well, fortunately, Metaculus has a pair of questions that ask users to predict how many infections and deaths there will be in 2022:

203 users(!) made 817 predictions of infections, and Metaculus helpfully aggregates those into a "community prediction" of ~248k infections. 77 users made 180 predictions of deaths, with a community prediction of 541.

The y-axis is on a log scale (as are the predictors' distributions). This is a good choice! Whatever you expect the most-likely case to be, there's definitely a chance with things like this that one a misestimation or shift in one factor can make it bigger or smaller by a multiple, not just an additive amount.

What's not a good choice is to report the median outcome of the aggregate position as the "community prediction". This causes a headline